- Yearly Spending Log- I like to compare month-to-month and year-to-year on my utilities, phone plans, auto insurances, and donations.

- Homeowners Insurance & Property Taxes- Again I like to have this information at my finger tips.

- Recommended Percentage Spending- This more or less a check & balance for my over all budget. This is copied right out of Dave Ramsey’s book. He has several worksheets available in his books.

I love this time of year!

It’s the best time to review and evaluate all the aspects of my life. I ask a lot of questions of myself ….…..What can I do differently? How can I improve the quality of my life? What areas are strong? What areas are weak?

After I shared how I get financially organized for the start of a “New Year”, I had many request to see how I organize my financial notebook. But before I continue, please let me make it known here and now that I am NO financial adviser. I am merrily sharing with you what works for me.

This notebook is all based on my following of Dave Ramsey’s baby step system. So let me share with you my financial notebook……

This notebook is pretty straight forward. No bells and whistle. You might be surprised at how simple this notebook really is BUT it is very effective. Hopefully you will be able to adapt some ideas for yourself. Oh on last thing, this notebook is set up for a weekly income. If you are paid bi-weekly or monthly then you will need to make the necessary adjustments.

{Front Inside Pocket}

Here I keep 4 envelopes, a small calendar, a pen, and my checkbook (I know, who writes out checks anymore!)

I also keep a list of all online account information (user IDs, passwords, account numbers, and pin numbers) not shown

The four envelopes are for inserting bills on the week that they will be paid. At least the ones that I still receive via USPS. If I have a reoccurring bill that has a direct-draft from my account, I will create a post card size note for myself and insert it in the envelope.

{3 Ring Binder}

First thing on the 3 ring binder is our Spending Plan for the current month. (all other months are printed and placed behind) For privacy, I’m showing you February because I have already filled in January’s spending plan. I recreated Dave Ramsey’s spending plan to fit my needs.

How to use:

Start by filling in the pay periods at the top. (there is an extra line for months that have 5 Fridays!) Fill in your income amount. Next start filling in your payments/bill information on the weeks that they will get paid. Dave Ramsey suggests that you start with your most important payments first (mortgage/rent, food, electric) and work around what income you have left to pay all other bills.

Take your weekly income and subtract everything you have to pay per that week. (hopefully you are still in the positive numbers) Whatever money is left, you need to allocate it somewhere. The ultimate goal is to end up with a zero balance per each week. Spending every penny on paper. Do that for each week.

Have a plan. Work the plan.

Dave Ramsey uses a cash envelope system to help keep you honest with your budget. I noted a * by each category that I use the cash envelopes.

{Part 2 of the 3 Ring Binder}

Three tabs at the top of the notebook:

{Part 3 of the 3 Ring Binder}

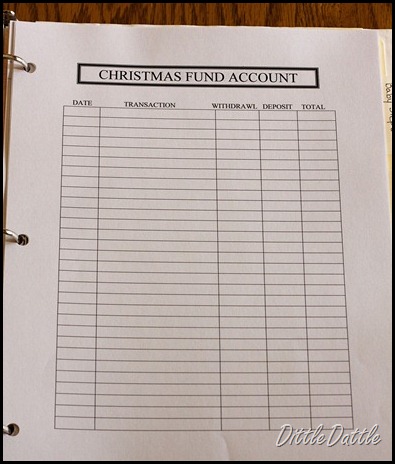

I mentioned I use ING Direct for my Christmas Fund Account in a past post but I forgot to mention that you can also create sub-account with in your savings! I think this is the greatest thing!!!! Now my automatic direct-draft to my savings account can be divided between our savings’ goals. Love that!!

I keep a paper register of each sub-account.

{Part 4 of the 3 Ring Binder}

The meat of Dave Ramsey’s Program. The 7 Baby Steps.

I keep a printed list of these steps.

Lastly, I have each step tabbed into it’s own section. Here I have blank note paper for record keeping, notes, goals, and any other important information to help us complete that step.

Pretty simple right?

Easy enough for you to create your own, TODAY!

Dave Ramsey has a Financial Peace University that you can locate at most near by churches. I have not taken the course myself. However, I have accessed every other FREE information that is available …... books from libraries, pod-casts, radio shows, TV shows, forums and chat rooms, anything I could get my hands,eyes, and ears on!

I implemented this notebook a few years back. It’s easy enough for me to use, and even though I do the bulk of the budgeting, the Hubby can pick it up and find any bit of information he needed, if I wasn’t around. If something happened to me I know he would not have any trouble accessing our accounts or pertinent information. Can you say the same about your financial records?

My hope is that this financial notebook or any tips that I have shared will make a difference in your year or even your life.

***

Now you can create your own financial notebook

(Click on photo to download. All files are created in WORD, adjust to suit your needs)